Ever looked at your monthly loan bill and thought, “Where is all my money really going?” If you’ve got a mortgage, car loan, or even student loans, understanding amortization can completely change the way you look at your payments — and might just save you thousands of dollars.

In this article, we’ll break down what amortization really means, how it works in real life, and why every American with a loan should understand this financial concept.

🧠 What is Amortization in Simple Terms?

Amortization is the process of paying off a loan over time through regular payments. Each payment you make is split into two parts:

-

Interest (what the lender charges you)

-

Principal (the actual loan amount you’re paying down)

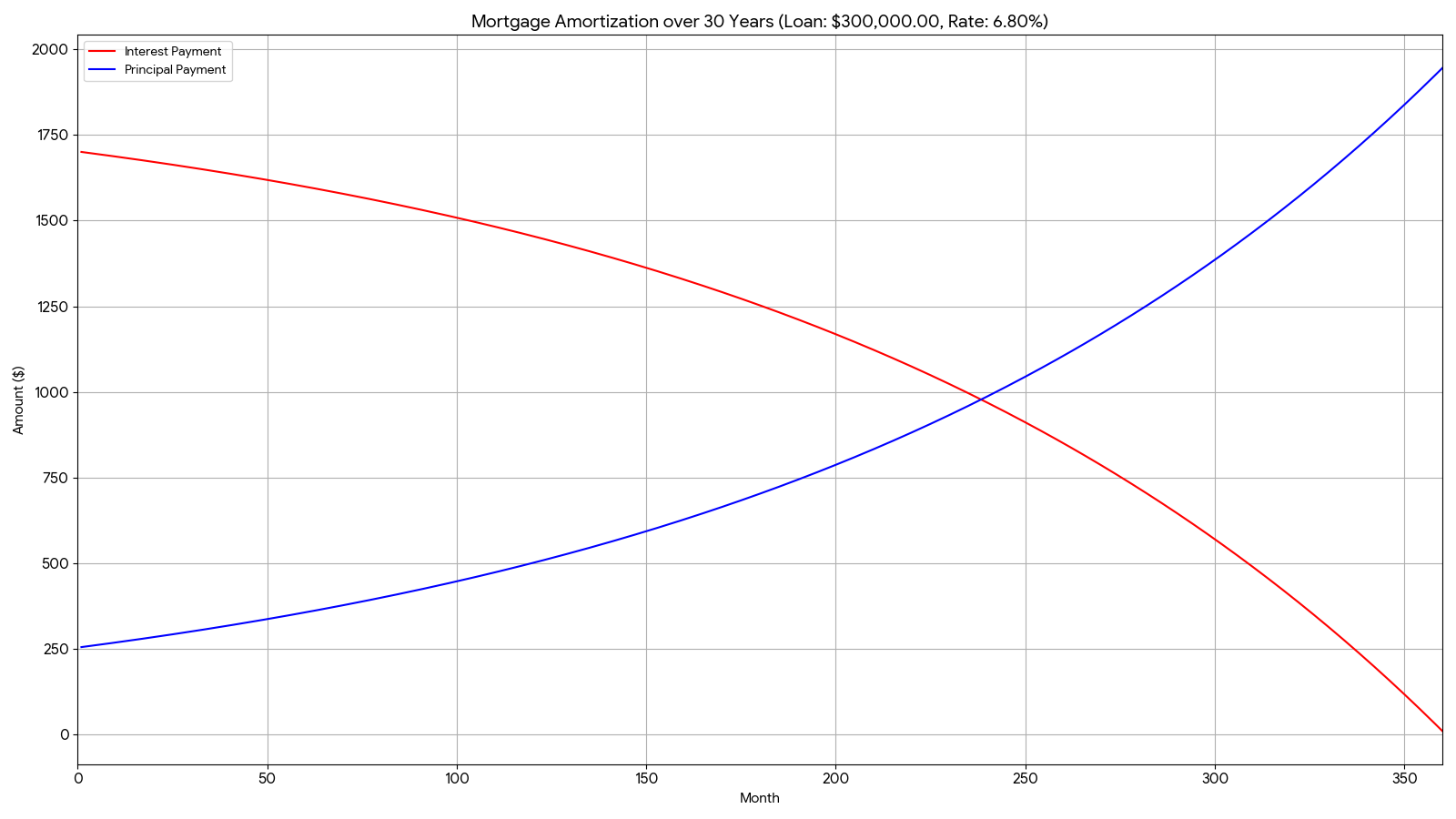

As time goes on, a bigger portion of your payment goes toward the principal, and less toward interest. This is called an amortization schedule.

Think of it like this:

You’re not just paying for the right to borrow money — you’re slowly buying back your financial freedom, one payment at a time.

🏠 Real-Life Example: Amortization in Action

Let’s say you take out a 30-year fixed mortgage for $300,000 at a 6.5% interest rate. Your monthly payment might be around $1,896. Here’s how amortization breaks it down:

-

In the first few years, most of that $1,896 goes toward interest.

-

By year 15, the tables turn — now most of your money is reducing the principal.

-

By year 30, you’ve paid off the entire loan.

So while your payment stays the same, the way it’s applied changes dramatically over time.

📊 What is an Amortization Schedule?

An amortization schedule is a detailed table that shows:

-

Each monthly payment

-

How much goes to interest

-

How much goes to principal

-

Remaining loan balance

Pro Tip: Ask your lender for this schedule or generate one using an online amortization calculator.

💡 Why Amortization Matters for You

Understanding amortization isn’t just for financial nerds — it’s for every working American trying to get ahead. Here’s why it matters:

✅ You’ll Pay Off Debt Smarter

Knowing how your payments are split helps you plan extra payments that actually reduce your loan faster.

✅ You Can Save Thousands in Interest

If you pay just a little extra on your mortgage each month, that money goes straight to the principal — which means less interest over the life of the loan.

✅ It Helps with Tax Planning

Some interest payments (like on mortgages) are tax deductible, which can affect your refund. Understanding your amortization helps you calculate those deductions better.

💸 Amortization vs. Depreciation — What’s the Difference?

You might also hear “amortization” in the context of business accounting, especially with intangible assets like software or patents.

But here’s the difference:

| Term | Used For | Meaning |

|---|---|---|

| Amortization | Loans or intangible assets | Spreading payments or costs over time |

| Depreciation | Physical assets (cars, buildings) | How things lose value over time |

If you’re a homeowner or borrower, the loan amortization definition is what matters most.

🙋♂️ FAQs: What Americans Ask About Amortization

Q: Can I pay off an amortized loan early?

Yes! You can make extra principal payments to reduce your balance faster — just make sure your lender doesn’t charge prepayment penalties.

Q: Does student loan amortization work the same?

Mostly yes, but with some federal student loans, your interest may capitalize, meaning it gets added to the principal if you pause payments.

Q: Is amortization good or bad?

Amortization itself is neutral — but understanding it helps you make smarter financial moves.

Q: What’s a balloon payment?

That’s when your loan is partially amortized — you pay smaller payments upfront and then one big lump sum at the end. Risky if you’re not prepared.

📈 How to Use Amortization to Your Advantage

-

Use online calculators before taking a loan to see your full schedule.

-

Make extra payments whenever you can — even $100/month can shave years off your loan.

-

Refinance if interest rates drop, and re-check your amortization schedule afterward.

Why You Should Care About Amortization

Let’s face it — loans are a part of American life. Whether it’s your home, car, or college degree, you’re probably paying something off right now.

Understanding amortization isn’t just a financial buzzword. It’s your map to freedom from debt.

The more you understand it, the less power lenders have over your future — and the more you can take control of your money, your home, and your life.