Can You Get a Home Loan with a 500 Credit Score?

Buying a home with a 500 credit score might seem impossible, but in 2025, there are still paths forward—if you know where to look. While your credit score is a crucial factor in loan approval, it’s not the only thing lenders consider.

What Is a 500 Credit Score Considered?

In most credit scoring models like FICO and VantageScore, a 500 score falls in the “very poor” category. Lenders see this as a high-risk score, often due to:

-

Late payments

-

High debt utilization

-

Bankruptcy or collections

-

Limited credit history

Minimum Credit Score Requirements by Lenders

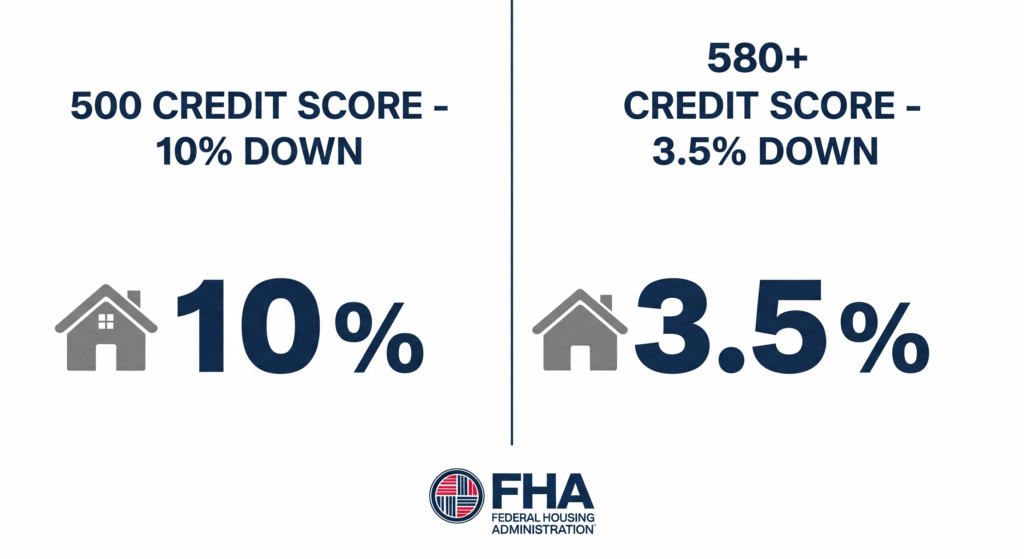

Most conventional lenders require a minimum score of 620, but some government-backed loans (like FHA) allow lower scores—with conditions.

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional Loans | 620+ |

| FHA Loan (10% down) | 500 |

| FHA Loan (3.5% down) | 580 |

| VA Loans | 580–620 (flexible) |

| USDA Loans | 640+ |

Special Home Loan Programs for Low Scores

-

FHA Loans: Your best bet with a 500 score

-

Manual Underwriting: Some lenders allow this when automated systems reject

-

Down Payment Assistance Programs: Offered at state/local level

Does Wells Fargo Offer Home Loans for 500 Credit Scores?

Wells Fargo is one of the largest mortgage lenders in the USA, but it tends to follow traditional lending guidelines, which may limit options for low-credit borrowers.

Wells Fargo’s General Credit Policy

-

Generally requires credit scores of 620+ for conventional loans.

-

They do offer FHA loans, but even then prefer scores of 580+.

-

Borrowers with 500 scores may be rejected unless they meet other compensating factors, such as a large down payment.

FHA Loans Through Wells Fargo

Wells Fargo does offer FHA-backed mortgages, which the government insures to reduce lender risk. These are more lenient in terms of credit requirements, but:

-

500–579 scores require 10% down payment

-

580+ scores qualify for 3.5% down

-

Must meet debt-to-income ratio and employment verification

Alternatives If You Don’t Qualify

If you’re denied by Wells Fargo, don’t panic. Consider:

-

Smaller banks or credit unions

-

Online mortgage lenders with flexible credit criteria

-

Building your credit for a few months and reapplying

FHA Loans: Your Best Bet with a 500 Credit Score

If your score is 500, FHA is your most realistic option in 2025.

Minimum Credit Score for FHA

-

Minimum accepted: 500

-

For better terms: Aim for 580+

Down Payment Requirements

| Credit Score | Minimum Down Payment |

|---|---|

| 580+ | 3.5% |

| 500–579 | 10% |

Pros and Cons for Low Credit Applicants

Pros:

-

Flexible credit criteria

-

Low down payment

-

Government-backed

Cons:

-

Higher interest rates

-

Mandatory mortgage insurance

-

Property must meet FHA standards

Tips to Improve Your Chances of Getting Approved

Even if your credit score is low, you can boost your odds of getting approved by following these smart moves.

Increase Your Down Payment

Putting down more money upfront reduces lender risk. Try to save at least 10% or more.

Add a Co-Signer or Co-Borrower

A family member or partner with good credit can strengthen your application.

Reduce Existing Debt

Pay down credit cards or personal loans. A lower debt-to-income ratio makes you more attractive to lenders.

Alternatives to Wells Fargo for Low Credit Mortgages

Wells Fargo may not be your best bet. These lenders are known to work with low-credit applicants:

Top Lenders That Accept Low Credit Scores

-

Carrington Mortgage

-

New American Funding

-

Rocket Mortgage (manual underwriting)

-

Caliber Home Loans

Online Mortgage Marketplaces

Use platforms like LendingTree or Zillow Home Loans to compare multiple offers with your score range.

Credit Unions vs Big Banks

Local credit unions often provide more personalized service and can be more flexible than national banks.

Realistic Expectations for Home Loans in 2025

Low credit doesn’t mean “no home loan”—but it does mean more diligence and patience.

What Lenders Want to See Besides Credit

-

Stable income and job history

-

Low debt-to-income ratio

-

Proof of rent payments

Trends in Low-Credit Lending

-

AI-powered underwriting giving more approvals

-

Government expansions on FHA/VA accessibility

-

Credit coaching offered by more lenders

Frequently Asked Questions

Can I get a home loan with a 500 credit score in 2025?

Yes, but mainly through FHA loans with at least 10% down payment. Most conventional lenders will not approve you.

What type of mortgage is best for low credit?

FHA loans are the best starting point. Consider VA loans if you’re a veteran or credit union programs if you qualify.

How much down payment do I need with bad credit?

If your score is 500–579, you’ll need at least 10% down. With 580+, you may qualify for 3.5% down via FHA.

Will Wells Fargo approve me with poor credit?

Only in select cases. Most applicants with 500 scores are rejected unless they have strong compensating factors.

Are there first-time buyer programs for low credit?

Yes! Many states offer down payment assistance and grants for first-time, low-credit buyers.

How long should I wait to reapply after rejection?

Wait at least 60–90 days, work on improving credit or saving more, then reapply with updated documents.

Final Thoughts: Don’t Lose Hope If Your Credit Is Low

Getting a home loan with a 500 credit score is tough—but it’s not impossible. While Wells Fargo may not be your best option, lenders like Carrington, FHA providers, and credit unions could be your ticket to homeownership. Stay proactive, know your options, and take one step at a time.