Published on [7/18/2025]

In the ever-evolving economic landscape, finance plays a vital role in the functioning of individuals, businesses, and governments alike. Whether you’re managing your monthly budget, running a startup, or analyzing national spending, understanding the different types of finance is essential.

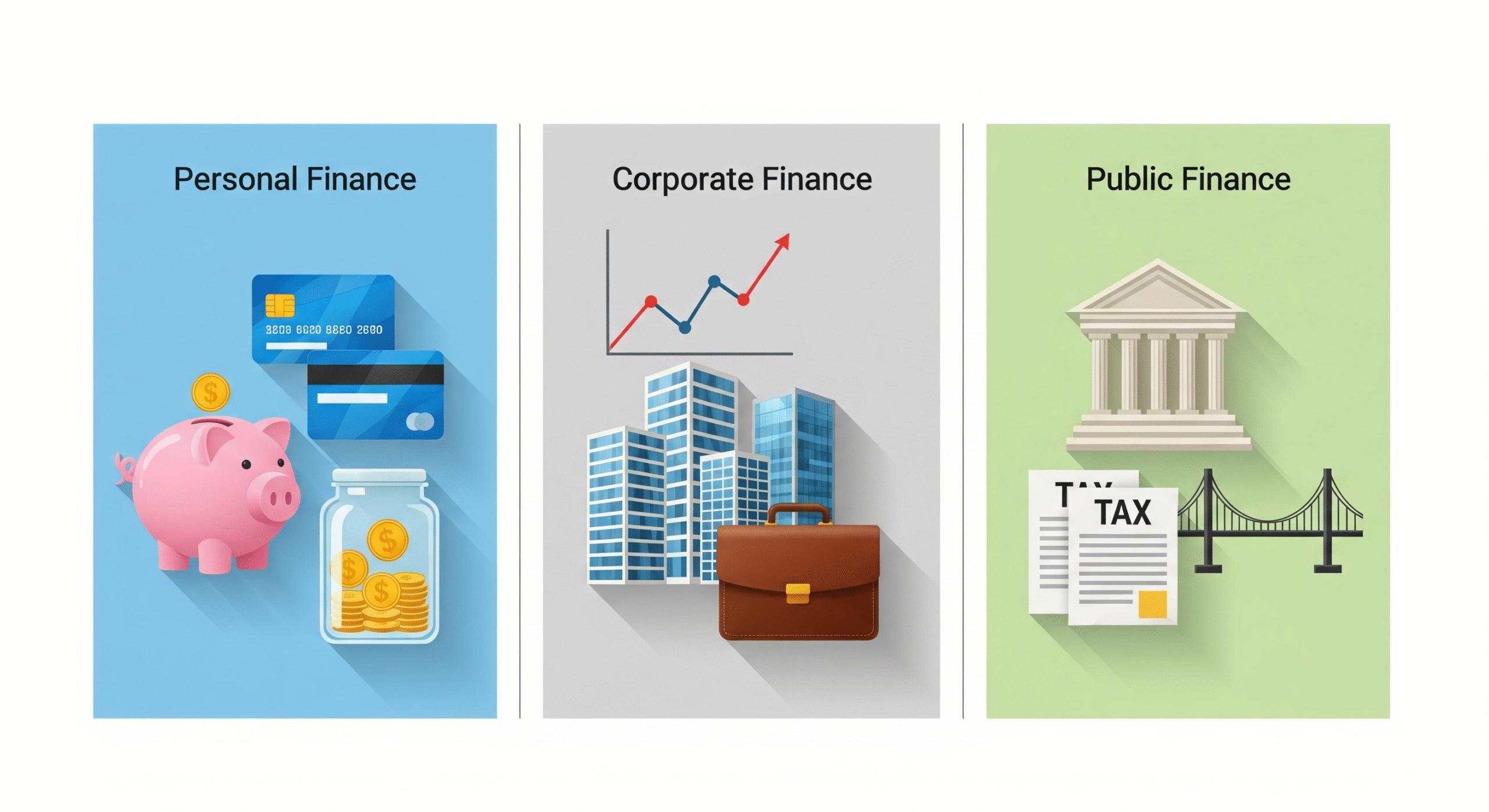

In this guide, we’ll explore the three main types of finance: Personal Finance, Corporate Finance, and Public Finance—explaining what they are, how they work, and why they matter. So, whether you’re a student, entrepreneur, or just someone wanting to get a grip on financial literacy, this is your go-to resource.

🔍 What is Finance?

At its core, finance is the management of money. It involves activities like borrowing, investing, budgeting, saving, and forecasting. Finance helps individuals meet personal goals, corporations grow strategically, and governments run efficiently.

The discipline is typically divided into three main categories:

-

Personal Finance

-

Corporate Finance

-

Public Finance

Let’s break each one down.

🧍♂️ 1. Personal Finance

Personal finance refers to the financial decisions and strategies that individuals or households use to manage their money. It covers everything from saving and budgeting to investing and retirement planning.

🔑 Key Components of Personal Finance:

-

Income Management – How much you earn (salary, side gigs, investments)

-

Budgeting – Creating a monthly spending plan to avoid debt

-

Saving – Emergency funds, short-term goals (vacations, buying a car)

-

Investing – Stocks, bonds, mutual funds, crypto, and real estate

-

Debt Management – Credit cards, student loans, mortgages

-

Retirement Planning – 401(k), IRAs, and long-term financial security

💡 Why It Matters:

In the U.S., the average household debt stands at over $100,000, highlighting the importance of sound personal finance. Good financial literacy helps avoid debt traps, build wealth, and ensure a secure future.

✅ Tools to Manage Personal Finance:

-

Budgeting apps like Mint or YNAB

-

Robo-advisors for investing (e.g., Betterment, Wealthfront)

-

Credit score monitoring via Experian or Credit Karma

🏢 2. Corporate Finance

Corporate finance deals with how companies manage their finances to maximize profits and shareholder value. This branch of finance is essential for businesses to operate efficiently, raise capital, and plan future growth.

🔑 Key Areas in Corporate Finance:

-

Capital Structure – Deciding the mix of debt and equity

-

Financial Planning – Short-term and long-term budget forecasting

-

Investment Decisions – Evaluating which projects will generate the best return

-

Risk Management – Identifying and mitigating financial risks

-

Dividend Policy – Determining when and how profits are shared with shareholders

💡 Why It Matters:

Efficient financial decisions can make or break a business. Whether you’re running a small startup or managing a multinational corporation, corporate finance helps determine how your business funds operations, invests in growth, and returns value to investors.

🧠 Example:

Imagine a company needs to buy a new manufacturing plant. Corporate finance strategies would analyze:

-

Should we take a loan or issue stock?

-

What’s the return on this investment?

-

How will this affect our cash flow and profitability?

🏛️ 3. Public Finance

Public finance is the study of how government entities—federal, state, and local—manage income, expenditures, and debt. It focuses on how resources are allocated in the public sector and how government policies influence the overall economy.

🔑 Key Functions of Public Finance:

-

Revenue Generation – Through taxes, fees, and duties

-

Government Spending – On infrastructure, education, defense, and healthcare

-

Budgeting – Planning how to allocate financial resources effectively

-

Debt Management – Issuing government bonds, managing national debt

-

Economic Stabilization – Using fiscal policies to control inflation, unemployment

💡 Why It Matters:

Public finance impacts every citizen. It determines:

-

How much tax you pay

-

The quality of public services (roads, hospitals, education)

-

National debt and its implications on interest rates and economic growth

🇺🇸 Example in the U.S.:

In 2024, the U.S. federal government spent over $6.3 trillion, with key allocations to Social Security, Medicare, and defense. Understanding public finance helps citizens evaluate policy decisions and their long-term economic impact.

🔄 How These Three Types of Finance Interconnect

Although they operate at different levels, personal, corporate, and public finance are deeply interconnected.

| Finance Type | Impact on Others |

|---|---|

| Personal Finance | Consumer behavior affects business sales and government tax revenue |

| Corporate Finance | Business investment decisions influence job creation and tax contributions |

| Public Finance | Government policy (like tax cuts or stimulus checks) affects individual and business spending |

For example:

-

A stimulus check (public finance) boosts consumer spending (personal finance), which benefits businesses (corporate finance).

📚 Why Understanding Finance Matters in the U.S.

In a country like the United States, where capitalism drives the economy, financial literacy is not optional—it’s essential. According to the National Financial Educators Council, lack of financial knowledge cost U.S. citizens over $1,800 per person in 2023.

By understanding these three core types of finance:

-

Individuals make smarter money decisions

-

Businesses plan better growth strategies

-

Citizens hold governments accountable

💼 Career Paths in Finance

If you’re inspired to dive deeper, here are some career options within each type of finance:

Personal Finance:

-

Financial Advisor

-

Credit Analyst

-

Insurance Agent

Corporate Finance:

-

CFO (Chief Financial Officer)

-

Investment Banker

-

Risk Analyst

Public Finance:

-

Policy Analyst

-

Budget Officer

-

Tax Consultant

The demand for finance professionals is high, and the average salary for finance careers in the U.S. is over $80,000 per year, according to the Bureau of Labor Statistics.

Conclusion

Finance is much more than numbers—it’s about smart decision-making at every level of society. Whether you’re managing a personal budget, steering a company’s growth, or creating policies that affect millions, understanding the types of finance—personal, corporate, and public—equips you with the power to make informed, impactful decisions.

At myfinancefuel.com, we’re dedicated to helping you fuel your financial knowledge and confidence. Stay tuned for more tips, tools, and insights that simplify finance for everyday Americans.