As cryptocurrencies continue to gain mainstream acceptance, investors are increasingly turning to crypto ETFs to gain exposure to this fast-moving market—without the need to directly buy Bitcoin or altcoins. With regulatory clarity improving in 2025, several big-name financial institutions like Fidelity, BlackRock, and (potentially) Vanguard are stepping into the crypto ETF space.

If you’re wondering which crypto ETFs to invest in, or whether crypto ETFs are good investments, this guide breaks down the 7 best cryptocurrency ETFs to consider in 2025, especially if you’re investing from the United States.

🔍 What Is a Crypto ETF? (Quick Breakdown)

A crypto ETF is an exchange-traded fund that tracks the price of a digital asset like Bitcoin or Ethereum or companies involved in the blockchain or cryptocurrency industry. Instead of buying crypto directly and managing wallets, investors can buy these ETFs through traditional brokerage accounts like Fidelity, Robinhood, or Charles Schwab.

There are two main types of crypto ETFs:

-

Spot Crypto ETFs: Track actual crypto prices (like Bitcoin).

-

Blockchain/Industry ETFs: Track companies involved in crypto or blockchain.

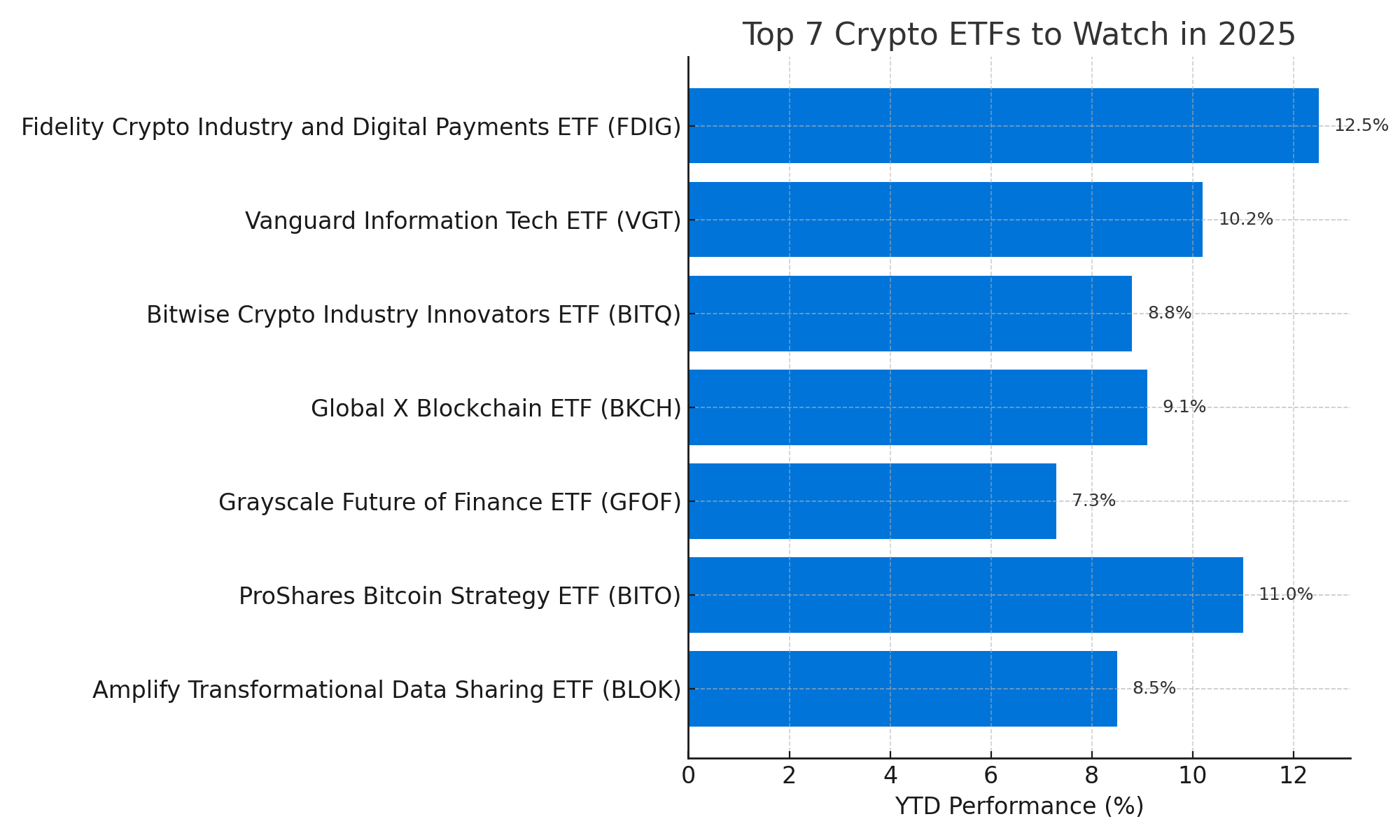

🏆 7 Best Crypto ETFs for Watch in 2025

1. Fidelity Crypto Industry and Digital Payments ETF (FDIG)

-

Type: Blockchain/Industry ETF

-

Expense Ratio: 0.39%

FDIG gives you exposure to companies driving digital payments and the crypto economy. It includes stocks like Coinbase, Block (Square), and Galaxy Digital. It’s a smart choice for those already using Fidelity and looking for a balanced crypto ETF.

2. iShares Bitcoin Trust ETF (IBIT)

-

Type: Spot Bitcoin ETF

-

Issued by: BlackRock

-

Why it matters: IBIT was one of the first SEC-approved spot Bitcoin ETFs in the U.S. It offers direct exposure to Bitcoin prices with institutional backing from BlackRock—a huge plus for conservative investors wanting crypto exposure.

3. Bitwise Crypto Industry Innovators ETF (BITQ)

-

Type: Blockchain ETF

-

Expense Ratio: 0.85%

This ETF tracks a portfolio of companies that earn at least 75% of their revenue from crypto. It’s more volatile but high growth. Includes names like Riot Blockchain and Marathon Digital.

4. Valkyrie Bitcoin Strategy ETF (BTF)

-

Type: Bitcoin Futures ETF

-

Why it matters: While not a spot ETF, BTF offers exposure to Bitcoin futures contracts. It’s an option for those who want to speculate on BTC’s short-term price without buying it directly.

5. Global X Blockchain ETF (BKCH)

-

Type: Blockchain Industry ETF

BKCH focuses on blockchain infrastructure companies. If you’re more interested in blockchain technology than crypto coins, this might be your pick. Includes NVIDIA, Coinbase, and Hive Blockchain.

6. VanEck Digital Transformation ETF (DAPP)

-

Type: Blockchain/Industry ETF

This fund focuses on companies transforming their business models using blockchain technology. A good option for investors who believe in the long-term application of blockchain beyond just crypto.

7. Grayscale Bitcoin Trust (GBTC)

-

Type: Trust (recently approved for ETF conversion)

Note: GBTC was recently converted into a spot ETF. Grayscale holds over 600,000 BTC, making it one of the largest players in the crypto ETF space.

Are Crypto ETFs Good Investments in 2025?

Here’s a quick look at the pros and cons of crypto ETFs:

👍 Pros:

-

Regulated and easier to trade than crypto directly

-

No wallets, private keys, or crypto exchanges needed

-

Accessible via platforms like Fidelity, Schwab, and Vanguard

-

Perfect for long-term investors seeking diversified exposure

👎 Cons:

-

Still volatile (crypto market is inherently risky)

-

Higher expense ratios than some index funds

-

Not all ETFs track actual crypto (some track companies instead)

ETFs to Watch on Fidelity and Vanguard

If you’re investing through Fidelity, the FDIG ETF is your go-to crypto fund right now. Vanguard currently doesn’t offer a direct crypto ETF, but it does offer exposure to blockchain-related companies through broader tech funds. Keep an eye out — many expect Vanguard to launch a crypto-related ETF soon.

FAQs About Crypto ETFs

Q: Can I buy crypto ETFs on Fidelity?

Yes, Fidelity offers FDIG and access to many third-party crypto ETFs.

Q: Are crypto ETFs safe?

They are generally safer than holding crypto directly, but they still carry market risk.

Q: What is the difference between spot and futures crypto ETFs?

Spot ETFs track actual prices. Futures ETFs track contracts based on future prices.

Q: Will Vanguard offer a crypto ETF?

Not yet, but pressure is building. For now, you can invest in tech/blockchain ETFs on Vanguard.

🧠 Final Thoughts

Crypto ETFs are one of the smartest ways to gain exposure to digital assets in 2025—especially for investors who don’t want to deal with wallets or exchanges. Whether you prefer Bitcoin spot ETFs like IBIT or industry-focused options like FDIG, the choices are growing fast.

📰 Tip: Set alerts for updates—new crypto ETFs may hit the market later this year.