Bitcoin is back in the spotlight, surging more than 50% since its April lows and eyeing a new all-time high. With a total market capitalization now over $2 trillion, the world’s most popular cryptocurrency is not just a speculative asset—it’s becoming a legislative priority. A new crypto bill, introduced this week in Congress, could send shockwaves through the digital economy.

This comes as tech titans like Elon Musk’s SpaceX and AI leader OpenAI embrace blockchain technologies, signaling that crypto is no longer fringe—it’s foundational.

A New Crypto Era: Congress Introduces a Landmark Bill

Senator Cynthia Lummis, a vocal crypto advocate, unveiled what she calls a “groundbreaking” piece of legislation designed to modernize the U.S. regulatory landscape for digital assets.

“This bill cuts through bureaucratic red tape and sets clear, common-sense rules for how digital technologies function in today’s real-world economy,” said Lummis.

Key features of the bill include:

- Tax exemption for crypto transactions under $300

- Deferred taxation on mined or staked crypto until the asset is sold

- Clarification on crypto lending regulations

The bill is fully paid for and is expected to streamline federal oversight across agencies like the SEC and CFTC.

Bitcoin ETFs and Treasury Inflows

Institutions are moving fast. BlackRock, the world’s largest asset manager, continues to acquire Bitcoin through spot ETFs. Meanwhile, companies following Michael Saylor’s lead, including newly formed “Bitcoin treasury” firms, have absorbed over $100 billion in BTC over the past three years.

Experts suggest that the new bill, combined with growing institutional involvement, may be the trigger for a second-half Bitcoin boom.

“We expect Bitcoin to hit new all-time highs by Q4, driven by ETF flows and regulatory clarity,” said Geoff Kendrick, Global Head of Digital Assets at Standard Chartered Bank.

📊 Bitcoin Price Momentum: What’s Fueling the Surge?

| Date | BTC Price (Approx.) | Key Event |

|---|---|---|

| April 2025 | $45,000 | Post-dip recovery |

| June 2025 | $60,000 | Institutional ETF inflows surge |

| July 2025 | $68,000 | New crypto legislation introduced |

| (Projected) Q4 2025 | $75,000+ | Full adoption of new crypto bill |

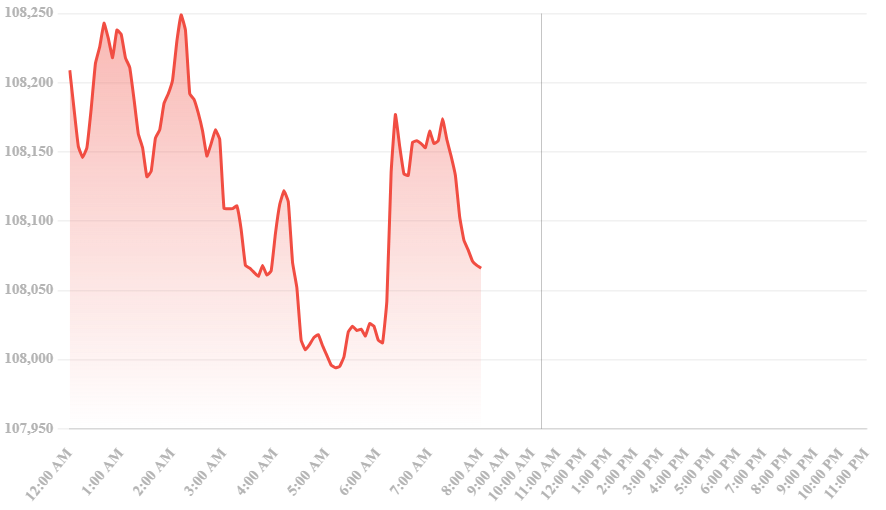

📉 Live Bitcoin Price Chart

🚀 Why This Bill Matters for Crypto’s Future

This legislation signals a shift: Washington is no longer ignoring crypto. Instead, it’s creating an environment where blockchain innovation can thrive. By treating small transactions with less scrutiny and incentivizing long-term holding, the U.S. is positioning itself as a global crypto leader.

Additionally, the announcement of “Crypto Week”—a House initiative to push three major bills including the Stablecoin Genius Act and Anti-CBDC Surveillance State Act—emphasizes the urgency of building a robust crypto economy.

Bitcoin’s current momentum is more than just market speculation—it’s a reflection of shifting regulatory tides. The U.S. government is warming up to digital assets, and if this crypto-friendly legislation passes, it could pave the way for massive adoption.

Investors, institutions, and everyday crypto users should keep their eyes on Washington—because what happens in Congress this year may define the next decade of Bitcoin.

FAQs: Bitcoin and the New Crypto Bill

Q1. What does the new crypto bill propose? It exempts transactions under $300 from taxes, defers taxes on mining/staking until coins are sold, and clarifies crypto lending rules.

Q2. How could this bill affect Bitcoin prices? The bill could drive adoption and investment by reducing tax burdens and regulatory uncertainty—potentially pushing Bitcoin to new highs.

Q3. Is this bill already law? No, it has been introduced in Congress and will undergo debate and voting before becoming law.

Q4. Who benefits the most from this legislation? Everyday crypto users, miners, and institutional investors looking for clarity and tax efficiency.