Author: myfinancefuel.com | Updated: July 2025

Buying a home is a major life decision, and one of the most important factors in that decision is the type of mortgage you choose. If you’re expl

oring your financing options, you’ve likely come across the term Adjustable Rate Mortgage (ARM). But what exactly is it? How does it work? And is it right for you?

In this guide, we break down everything you need to know about adjustable rate mortgages, how they compare to fixed-rate loans, and what determines whether your rate goes up or down over time.

📌 Table of Contents

-

What Is an Adjustable Rate Mortgage?

-

How Do Adjustable Rate Mortgages Work?

-

Key Components of an ARM

-

Fixed vs Adjustable Rate Mortgage

-

Pros and Cons of Adjustable Rate Mortgages

-

What Best Determines Whether a Borrower’s Interest Rate Goes Up or Down?

-

Adjustable Rate Mortgage Rates in 2025

-

Adjustable Rate Mortgage Calculator: How It Helps

-

Adjustable Rate & Tracker Mortgages: What’s the Difference?

-

Is an ARM Right for You?

-

Conclusion

-

FAQ

What Is an Adjustable Rate Mortgage?

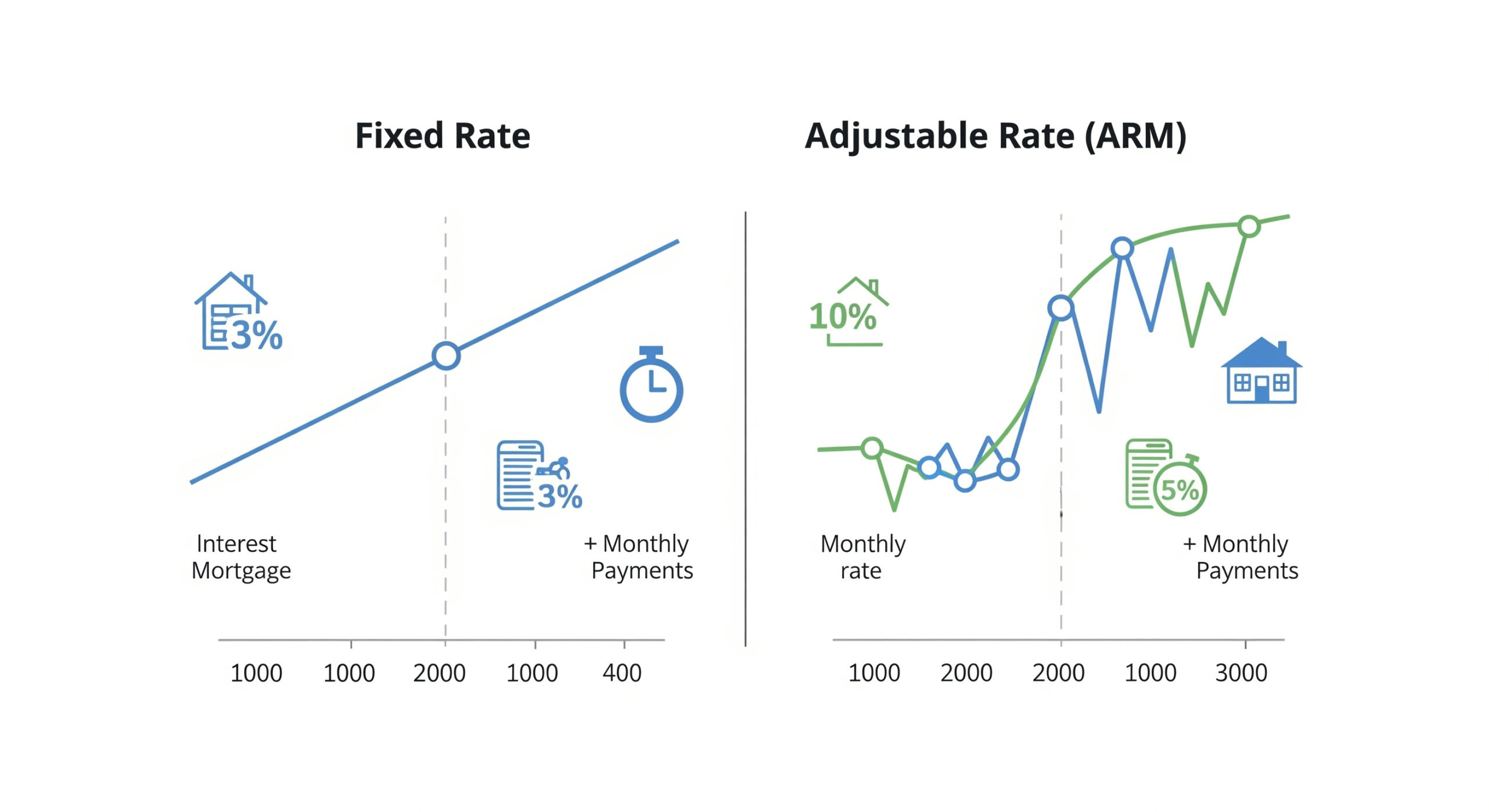

An Adjustable Rate Mortgage (ARM) is a type of home loan where the interest rate changes over time. Unlike a fixed-rate mortgage, where your interest rate stays the same for the life of the loan, an ARM starts with a fixed interest rate for a certain period and then adjusts periodically based on market conditions.

Think of it this way: in the early years, you enjoy lower interest rates, but once the fixed period ends, your monthly payment could increase or decrease depending on the economy.

How Do Adjustable Rate Mortgages Work?

ARMs typically come with two main phases:

-

Initial Fixed-Rate Period – This is usually 3, 5, 7, or 10 years where the interest rate remains the same.

-

Adjustment Period – After the fixed period, your rate adjusts annually or semi-annually based on an index.

For example, a 5/1 ARM means you’ll have a fixed rate for the first 5 years, then the rate will adjust every 1 year afterward.

Key Components of an ARM

Understanding how ARMs function involves knowing these key terms:

-

Index: A benchmark interest rate (like the SOFR – Secured Overnight Financing Rate) that reflects general market conditions.

-

Margin: A fixed percentage added to the index by your lender to determine your total interest rate.

-

Cap: Limits on how much your interest rate can increase at each adjustment or over the life of the loan.

-

Initial Cap: Limit for the first adjustment.

-

Periodic Cap: Limit for later adjustments.

-

Lifetime Cap: Maximum increase allowed over the life of the loan.

-

Fixed vs Adjustable Rate Mortgage

| Feature | Fixed-Rate Mortgage | Adjustable Rate Mortgage |

|---|---|---|

| Interest Rate | Fixed for life of the loan | Changes after the fixed period |

| Monthly Payment | Consistent | May increase or decrease |

| Initial Cost | Higher | Lower |

| Risk | Low | Medium to High |

| Ideal For | Long-term homeowners | Short-term buyers or investors |

If you plan to move or refinance within a few years, an ARM could save you money. But if you plan to stay for 15-30 years, a fixed-rate loan offers more peace of mind.

Pros and Cons of Adjustable Rate Mortgages

✅ Pros:

-

Lower Initial Rates: ARMs generally offer lower initial interest rates than fixed-rate mortgages.

-

Lower Payments Early On: This could help you qualify for a larger loan or afford a better home.

-

Potential to Save: If rates stay low or fall, you could pay less over time.

❌ Cons:

-

Uncertainty: Your rate — and monthly payment — could rise significantly.

-

Complexity: ARMs involve more moving parts (indexes, margins, caps).

-

Refinancing Risks: If home values drop or your credit score worsens, you may not be able to refinance later.

What Best Determines Whether a Borrower’s Interest Rate on an Adjustable Rate Loan Goes Up or Down?

The answer lies in the index your mortgage is tied to.

Key Factors:

-

Financial Index Movement: The most common indexes (like SOFR or the 1-Year Treasury) move with economic trends and inflation.

-

Federal Reserve Decisions: When the Fed raises or cuts interest rates, it directly influences index values.

-

Global Economic Conditions: Recessions, wars, pandemics — all can impact interest rate movement.

Important Note: Your lender cannot arbitrarily change your rate. It must follow the formula outlined in your loan agreement.

Adjustable Rate Mortgage Rates in 2025

In mid-2025, adjustable rate mortgage rates are seeing a rise in popularity due to recent interest rate cuts by the Federal Reserve. Here’s what the current landscape looks like:

| ARM Type | Average Initial Rate (2025) |

|---|---|

| 5/1 ARM | 6.10% |

| 7/1 ARM | 6.30% |

| 10/1 ARM | 6.45% |

Note: Rates vary based on credit score, location, loan amount, and lender. Always compare quotes.

Adjustable Rate Mortgage Calculator: Your Financial Friend

Before choosing an ARM, it’s smart to use an Adjustable Rate Mortgage Calculator. This tool helps you estimate:

-

Your initial monthly payment

-

Payment after adjustment

-

Total interest paid over time

You can find several free ARM calculators online or directly through lenders like Wells Fargo, Chase, or Bank of America.

Adjustable Rate & Tracker Mortgages: What’s the Difference?

While they sound similar, there are subtle differences:

-

Adjustable Rate Mortgages adjust based on a benchmark + margin.

-

Tracker Mortgages typically track a specific index directly (like the Bank of England rate in the UK), but aren’t as common in the U.S.

In the U.S., ARMs are the standard, while tracker mortgages are more popular in the UK and Europe.

Is an ARM Right for You?

You might consider an ARM if:

-

You’re buying a starter home and plan to move or refinance before the rate adjusts.

-

You expect interest rates to drop or remain stable.

-

You want to lower your initial payments and manage cash flow.

Avoid ARMs if you:

-

Want stable, predictable payments

-

Plan to stay in your home long-term

-

Are uncomfortable with financial risk

An Adjustable Rate Mortgage can be a powerful tool — but it’s not for everyone. If used strategically, it could help you afford more home upfront and save money, especially if you’re planning a shorter stay or expect rates to drop.

But like any financial decision, it requires careful planning, an understanding of the risks, and regular financial checkups.

Explore your options, compare rates, and consult a mortgage advisor before locking in a decision.

❓ FAQ

Q1: What is an adjustable rate mortgage?

An adjustable rate mortgage (ARM) is a loan where the interest rate changes after a fixed initial period based on a market index.

Q2: What best determines whether a borrower’s rate goes up or down?

It depends on the performance of a financial index (like SOFR) and the Federal Reserve’s interest rate decisions.

Q3: How often do ARM rates change?

Usually, ARM rates adjust annually after the initial fixed period, but some adjust semi-annually.

Q4: Is an ARM better than a fixed-rate mortgage?

It depends on your situation. ARMs offer lower initial rates, while fixed-rate loans offer predictability.

Q5: Can I refinance an ARM to a fixed-rate mortgage later?

Yes, many borrowers refinance when their ARM is about to adjust or when rates are favorable.

Q6: Are ARMs risky?

They can be if you’re not prepared for rate increases. Always check the caps and understand your worst-case scenario.

Q7: Where can I check adjustable rate mortgage rates?

Major U.S. lenders like Wells Fargo, Chase, and websites like Bankrate or myfinancefuel.com update rates regularly.

Need more help deciding on a mortgage? Visit myfinancefuel.com for expert guides, calculators, and real-time mortgage rates designed for the U.S. market.