The Federal Reserve finally did it — after months of speculation, the much-anticipated 2025 interest rate cut is here. For investors, this is a key signal: the market is shifting, and it’s time to reposition portfolios for growth. But what should you buy now?

If you’re wondering what ETFs to invest in for 2025, you’re in the right place. In this article, we’ll break down the best ETFs for 2025, how interest rates affect the ETF market, and where smart money is going post-cut.

💼 Why Interest Rate Cuts Matter for ETF Investors

An interest rate cut typically:

-

Boosts borrowing and spending

-

Weakens the dollar

-

Increases corporate earnings

-

Pushes stock prices and risk assets higher

This environment favors growth stocks, technology, and risk-on ETFs. That’s why smart investors are rotating their capital into specific exchange-traded funds right now.

📈 Best ETFs to Buy in 2025 After the Rate Cut

Here are the top ETFs experts and institutional investors are watching right now:

1. SPDR S&P 500 ETF Trust (SPY)

-

Why it’s hot: The classic S&P 500 ETF remains the most liquid and safest way to ride a bull market.

-

Post-cut outlook: Rate cuts historically boost large-cap performance, and SPY captures them all.

-

Keyword focus: ETFs SPY, are ETFs good investments

2. Invesco QQQ Trust (QQQ)

-

Why it’s hot: Tracks the NASDAQ-100, packed with growth and tech leaders like Apple, Nvidia, and Microsoft.

-

Post-cut outlook: Lower rates benefit high-growth companies by reducing borrowing costs.

-

Keyword focus: ETFs NASDAQ, what ETFs to invest in

3. iShares Russell 2000 ETF (IWM)

-

Why it’s hot: Small-cap stocks thrive when credit is cheap and economic outlooks improve.

-

Post-cut outlook: Rate cuts often trigger rallies in small-cap sectors.

-

Pro tip: A good play for risk-tolerant investors.

4. Vanguard Total Stock Market ETF (VTI)

-

Why it’s hot: Gives exposure to the entire U.S. stock market, including large-, mid-, and small-cap stocks.

-

Post-cut outlook: Great for long-term growth in a low-rate environment.

-

Keyword tie-in: best ETFs for 2025

5. ARK Innovation ETF (ARKK)

-

Why it’s hot: Cathie Wood’s innovation-focused ETF is volatile — but explosive in growth environments.

-

Post-cut outlook: Lower interest rates help the speculative tech that ARKK targets.

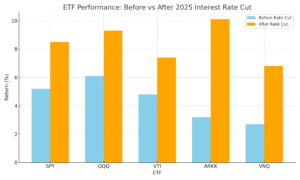

ETF Performance Comparison: Before vs. After 2025 Interest Rate Cut

🧠 Are ETFs Good Investments Right Now?

Yes — especially in a falling interest rate environment. ETFs offer:

-

Diversification

-

Liquidity

-

Low cost

-

Exposure to sectors that benefit from rate cuts

They’re ideal for both beginner and advanced investors who want hands-off portfolio exposure without buying individual stocks.

🌎 Where Smart Money Is Flowing

According to recent fund flow data, investors are moving capital into:

-

Technology ETFs

-

U.S. equity broad-market ETFs

-

Emerging markets ETFs (to take advantage of a weaker dollar)

If you’re looking for what ETFs to invest in during 2025, focus on funds that thrive in a lower-interest-rate world. The next bull run may already be underway — and ETFs like SPY, QQQ, and ARKK could be leading the charge.

Don’t wait for the market to fully price in the Fed’s move. Get ahead now.

FAQ: ETFs After the 2025 Interest Rate Cut

Q: What are the best ETFs for 2025?

A: SPY, QQQ, VTI, ARKK, and IWM are top picks based on current macro trends.

Q: Are ETFs a good investment right now?

A: Yes. With interest rates falling, ETFs offer great exposure to high-growth sectors.

Q: Which ETFs benefit most from rate cuts?

A: Growth-focused ETFs like QQQ and ARKK typically benefit most from lower borrowing costs.

Q: Should I sell my bond ETFs now?

A: Bond ETFs may lose steam short-term, but long-duration bonds could still benefit as yields fall.